Download PDF

EyeNet investigates the forces at work behind rising prices and shortages.

It wasn't so long ago that bottles of phenylephrine hydrochloride 2 percent and 10 percent eyedrops cost the EyeMD Laser and Surgery Center, in Oakland, Calif., around $5 a bottle. Today, the price tags are $60 and $100, respectively, for the same size bottles and this is a generic medication.

But weren't generic drugs supposed to save everyone money? Why have prices for ophthalmic generics skyrocketed over the last two years, and why are some in short supply?

Shortages: Factors

Experts who have studied changes in the U.S. drug industry over the last decade say the underlying reasons for the supply-demand mismatch and rising prices include:

- Financial instability at generic companies, which can lead them to abruptly cease operations.

- Narrow profit margins that favor high-volume, low-cost firms. These low margins also cause generic manufacturers to plan their production carefully to avoid surplus inventory.

- Manufacturing problems at generic drug companies that can lead to compromised, substandard products that the federal inspectors ban from being imported or used to manufacture drugs in the United States.1 (The FDA's Good Manufacturing Practices are tight, especially for lots requiring sterility [e.g., ophthalmics] or those in glass containers [e.g., propofol]).

- Inventive (but legal) strategies that allow manufacturers of brand-name drugs to circumvent the limitations of a 30-year-old federal law that was intended to increase competition from generics and level the playing field.

- Efforts by a branded drug's maker to suppress sales of the first generic product even going as far as paying a rival firm to postpone its drug's debut.2,3

- Corporations seeking novel ways to maximize shareholder return. Sometimes this takes the form of acquiring the rights to a common medication, withdrawing it from the market, and later reintroducing it at a higher price.

- Bargain hunting by large purchasing groups, clinics, and surgery centers when they buy pharmaceuticals. This puts downward pressure on already-slim profit margins for the generic manufacturers.

For small companies that produce medicines for a small health care sector like ophthalmology, it can be difficult to stay in business, said Marvin Shepherd, PhD, director of the Center for Pharmacoeconomic Studies in the College of Pharmacy, at the University of Texas at Austin.

Profit problems. “The reason shortages happen is that, in most cases, there is little money in making these generic products. The profit margin for generic drug manufacturers is around 5 percent, whereas for brand-name drug manufacturers the profit margins average over 30 percent,” Dr. Shepherd said. “If you’ve got 20 generic companies sharing the market, the margins and volumes are very thin. Some companies will bow out and leave a larger volume for others. When this happens, there is reduced competition, and thus you may see price increases,” he said.

The U.S. Food and Drug Administration (FDA) is limited in what it can do to ameliorate the drug shortages, and it has no power by law over prices, said Marcia Crosse, PhD, director of the health care group of the U.S. Government Accountability Office (GAO). “The federal government does not have authority to make a private business manufacture something, and so if a company wants to stop making a product, that’s their right,” she said.

Reactions in the clinic. Richard H. Lee, MD, the Oakland, Calif., comprehensive ophthalmologist who was shocked by the prices his practice and surgery center now pay for phenylephrine, said prices are causing him greater consternation than medication shortages are.

“Just about everything is [priced] higher. It’s pretty frightening. Some antibiotic-steroid combinations that became generic are almost as expensive as the brand-name drugs,” Dr. Lee said. In those cases the generic version saves only about 20 percent, apparently because there is only one manufacturer, he said.

Peter T. Zacharia, MD, a glaucoma subspecialist in Worcester, Mass., said that he is outraged about the problems. “It’s unbelievable. Here we are in the United States in 2014, and we have the type of shortages that they had in the Soviet Union in the 1970s and ’80s,” he said. “I’ve become really angry about this. In a country where we have iPhones in every pocket, these generic drugs should, for one, be available; and they should also be less costly.”

History and Some Numbers

The 1984 drug-patent-reform law known as the Hatch-Waxman Act gave Americans greater access to generic medicines. Today, about 80 percent of the prescription medications purchased are less expensive, generic versions of brand-name drugs.4

“Generics saved $217 billion in 2012 and more than $1 trillion over the recent decade, which equates to $1 billion in savings every other day,” said Ralph G. Neas, president and CEO of the Generic Pharmaceutical Association, in Washington,

D.C.

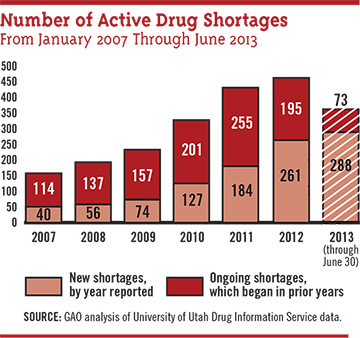

But Hatch-Waxman did not anticipate that market pressures, both unplanned and deliberate, ultimately might make some generic drugs scarce. “Shortages are at much higher levels than they were just a few years ago, and I know that ophthalmic drugs have been among those that have been in critical shortages,” Dr. Crosse said.

At the request of Congress, her office has published three extensive reports about the magnitude of drug shortages.5-7 Another is planned for 2015, she said.

Scarce ophthalmics. In 2012, the number of drugs in short supply in the United States was 456, according to a GAO report based on data kept by the University of Utah’s Drug Information Service. Six of the ophthalmic drugs in short supply were designated as being in critical shortage.7

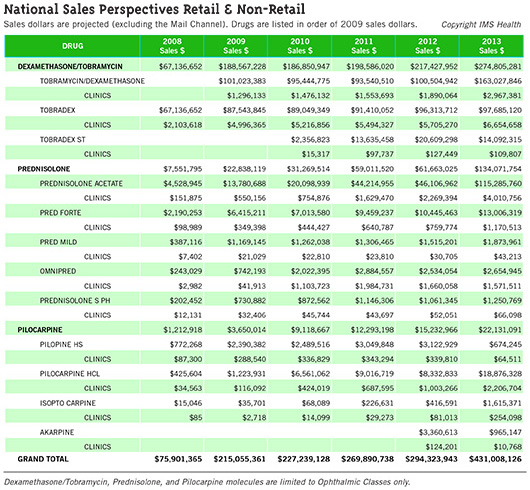

Ophthalmologists’ total outlay for various generic drugs increased—sometimes dramatically—according to IMS Health, a widely cited source of data on the pharmaceutical industry. IMS Health prepared figures forEyeNet about three ophthalmic drugs that saw notable increases—and it is unlikely that the number of prescriptions jumped sharply enough to account for the change. (See “National Sales Perspectives Retail and Non-Retail”). The IMS report contains sales data for several formulations of three common ophthalmic drugs (tobramycin/dexamethasone, prednisolone, and pilocarpine) purchased by clinics, which includes nongovernment clinical offices and ambulatory surgery centers. The report traced these price trajectories:

- Pilocarpine hydrochloride (generic): Spending on this drug rose from $116,092 in 2009 to $2.2 million in 2013.

- Prednisolone acetate (generic): Purchases totaling $550,156 in 2009 increased to $4 million in 2013. By comparison, Pred Forte (prednisolone acetate 1 percent, Allergan) rose less steeply from $349,398 in 2009 to $1.17 million in 2013.

- Tobramycin/dexamethasone (generic): Purchases of $1.3 million in 2009 increased to just under $3 million in 2013. The brand-name formulation Tobradex (Alcon) increased from $4.99 million in 2009 to $6.6 million in 2013. Tobradex ST expenditures were $15,317 in 2010 (the first year of availability) and $109,807 in 2013.

Changes at the FDA in response. The FDA has implemented some procedural changes suggested by a 2011 GAO report, among them the establishment in 2011 of the agency’s first-ever systematic database to document drug shortages. The FDA helped avert 154 generic shortages during 2012, nearly twice the number it headed off in 2011, the GAO reported.7 But challenges remain. “We see some progress in that the number of new drug shortages overall seems to be decreasing; nevertheless, a number are persisting, so the total number is still growing,” Dr. Crosse said. A list of drug shortages can be found at www.accessdata.fda.gov/scripts/drugshortages/default.cfm.

|

Web Extra

|

|

Production Breakdowns & Shutdowns

A consequence of small profit margins at generic drug companies becomes obvious whenever the FDA announces a drug shortage caused by a mechanical breakdown or a quality issue at the manufacturing plant. Together, these endemic problems cause about 70 percent of all the shortages. Some sources have told the GAO that the low profit margins limit the companies’ financial resources to maintain and upgrade production facilities, Dr. Crosse said.

Nor do these firms have redundant production capabilities to keep a plant running despite broken equipment. So every little blip in a generic drug maker’s processes—from a mechanical breakdown to deficiencies found by an FDA inspector—has the potential to completely stop them from making products that physicians and patients still need, Dr. Crosse said. “This is the downside of a low-cost product,” she added.

(click to expand)

The Paradox of Competition

“In the past 10 years, competition in the generics industry has increased tremendously. The number of generic products on the market for any one drug has escalated,” Dr. Shepherd said.

This intense competition brings lower prices in the short run, but in the long run the opposite effect occurs, Dr. Shepherd said. “I’ve done some work on this, and I found that the competition gets really tight after about a year. It really gets nasty.

“At first, as more products enter the market, the price drops, and that’s what we’ve seen in the past. It gets to the point where it is really tough to make any money,” Dr. Shepherd said. “So a lot of companies will decide: ‘We don’t sell enough of this product to even produce it,’ and they exit the market.”

Eventually, only a couple of manufacturers will remain, and at that point they will begin pushing prices upward for their generic drugs instead of down, Dr. Shepherd said. “One manufacturer will increase his price, and then the other one will, too. And now they’re both making money. There’s no collusion in this. It’s just that they weren’t making much money on this product, and so they raised their prices.”

The Influence of “Big Pharma”

Investigations by the Federal Trade Commission (FTC) and others have identified certain practices by major firms that, they suggest, protect lucrative brand-name drugs at the expense of the generic versions.

1. Pay-for-delay. By far, the most controversial method of mitigating the impact of generics is a pay-for-delay agreement, under which the manufacturer of a brand-name drug settles patent lawsuits with a generic drug company by paying it to stay out of the market. A 2010 FTC study found that payments under such agreements postponed generic market entry by an average of 17 months.2

The FTC has filed a number of lawsuits in opposition to such sweetheart deals, and the agency has asked Congress to prohibit them. But the number of pay-for-delay agreements has been mounting since 2005, when court rulings cleared the way for them. There were 40 pay-for-delay patent settlements in fiscal year 2012, involving 31 different branded drugs with annual U.S. sales of approximately $8.3 billion.3

(Asked to comment, a spokeswoman for the Pharmaceutical Research and Manufacturers of America [PhRMA] wrote in an e-mail: “Patent settlements allow generics on the market prior to expiration of the patent, benefitting both the innovator and generic companies by removing the uncertainty and cost of litigation and benefitting consumers.”)

2. Going generic preemptively. Sometimes a company decides to compete with itself by releasing an “authorized generic” version of its brand-name drug at the same time that the first generic from another company enters the market. On average, the presence of an authorized generic cuts revenues for the generic company by 40 to 52 percent, and this impact continues for three years, the FTC reported.3

3. Reformulating the branded drug. As patent exclusivity on a popular brand-name drug is nearing an end, companies sometimes begin using the FDA’s rules about what makes a drug “new” to preserve their market share. A high-profile example of this involved repeated reformulations of the lipid-modifying drug fenofibrate.8

This strategy typically involves 1) slightly tweaking the original drug’s chemistry or changing the dosing or how it looks; 2) minor rebranding of the new drug, for instance, by adding a couple of uppercase letters to the predecessor drug’s familiar name; and 3) heavily marketing this “new” proprietary medication, Dr. Lee said.

The slight changes to the original therapeutic molecule are beneficial in a few cases, but they usually aren’t, Dr. Lee said.

A Sampling of Costly and Missing Drugs

ACETAZOLAMIDE. “We buy bottles of it for the office, 100 [extended-release capsules] of 500 mg each. I don’t know exactly what the cost was a couple of years ago, but I know it was less than $50. Recently we were quoted $350 for the same product. And I know patients are paying more for it, too,” Dr. Zacharia said.

CARBACHOL. “It’s no longer available,” Dr. Zacharia said. “I’ve had patients on this drug whose pressure was well controlled with it, but they subsequently required surgery because the drug was not available.”

ECHOTHIOPHATE POWDER. An ingredient for making phospholine iodide ophthalmic solution, echothiophate is generic, but there is only one company making it, according to the Utah drug shortages database. Intermittent shortages began in 2006 and still are occurring today, the database indicates. “I tried to prescribe it recently because I heard it was available, and I found out that it was going to cost my patient a fortune,” Dr. Zacharia said.

EPINEPHRINE (unpreserved). “We can’t get this readily anymore. And it really doesn’t make sense to me,” Dr. Zacharia said.

BRIMONIDINE TARTRATE. Because he is a glaucoma subspecialist, Dr. Zacharia is particularly affected by what happened with this topical drug to lower intraocular pressure. “The biggest crime—and, yes, I’m calling it a crime—is with brimonidine. The brimonidine 0.15 percent costs several times more than brimonidine 0.2 percent,” he said. “Why should 0.2 percent be so much cheaper? It doesn’t cost any more to make the 0.15 percent. But the drug companies know that we would prefer to prescribe 0.15 percent because it’s going to have fewer systemic side effects, with the same efficacy. There’s no real reason for it other than just pure unbridled greed,” he said.

|

Losing Phenylephrine: A Case Study

In the spring of 2013, a single manufacturer’s version of ophthalmic phenylephrine hydrochloride, a topical mydriatic that ophthalmologists have used in generic form for decades, won formal FDA approval as a “new” drug. The New Drug Application (NDA) was given a priority review because of an “unmet medical need,” according to FDA documentation.9 The decision marked the beginning of the end of this long-generic drug’s status as an easily available, low-cost drug in the United States, the record shows.

An NDA supported by a literature review. Paragon BioTeck made the scientific case in support of its NDA by reviewing and summarizing the literature on phenylephrine’s effectiveness and safety in the eye; no additional clinical studies were done.9,10 The company did not claim that its FDA-approved eyedrops would be substantively different from or better than generic versions that other companies continue to try to sell. But the FDA’s action enabled Paragon to begin making marketing statements that no one else could, such as this one from an April 19, 2013, press release: “There is no longer a need to continue using unapproved versions of Phenylephrine Hydrochloride Ophthalmic Solution.”

First, the end of competition. The impact on Paragon’s competitors was swift and total. Although there was no exclusivity period prohibiting competitors from gaining FDA approval in the same way that Paragon did, the process of securing an abbreviated NDA—which competitors would need to do—can involve considerable time and effort. Within four months of the FDA’s decision, all three other makers of generic phenylephrine eyedrops withdrew from the market, and ophthalmic clinics and surgery centers began encountering product shortages, according to the American Society of Health-System Pharmacists’ online database. In June 2014, however, Paragon announced that the company to which it had licensed phenylephrine ophthalmic, Bausch + Lomb, had begun producing enough drug to make it “readily available” again.

But the price of this 70+-year-old medication—not widely available—has risen precipitously, said Linda Tsai, MD, of Washington University in St. Louis, Mo. Her institution paid $8 to $10 per bottle for phenylephrine drops a few years ago; recent price quotes were for $30, $35, and $100, she said.

“The thing that is disheartening for us is that we have been using this drug for years,” Dr. Tsai said. “Every institution that I have talked to has stated they are not likely to use very much of the new, costly medication.”

|

Web Extra: Further Reading

|

|

Then, clinical consequences. Dr. Tsai said the lack of easy and inexpensive access to phenylephrine has clinical consequences in virtually every cataract surgery center and ophthalmic clinic in the United States. “There’s no substitute for it. It’s the only adrenergic receptor drug, the only one that works on the sympathetic pathway, to increase dilation. The other ones are parasympathetic,” she said.

Dr. Zacharia said his practice, as well as the hospital where he performs glaucoma and cataract surgeries, has encountered similar problems. “The cost of phenylephrine has jumped dramatically,” he said. “We no longer use it in the operating room. At the hospital where I operate, they told us they aren’t able to get it anymore.”

Dr. Tsai speculated that some ophthalmologists will adopt a middle ground. “I think what everyone is going to do is switch to tropicamide in the clinic and then decide if it’s worth using phenylephrine for things like presurgical dilation or in a patient who is difficult to dilate, such as a diabetic,” she said.

__________________________

1 U.S. Food and Drug Administration. Regulatory actions against Ranbaxy. Accessed Oct. 30, 2014.

2 U.S. Federal Trade Commission. Pay-for-Delay: How Drug Company Pay-offs Cost Consumers Billions. January 2010. Accessed Oct. 30, 2014.

3 U.S. Federal Trade Commission. Overview of Agreements Filed in FY 2012: A Report by the Bureau of Competition. January 2013. Accessed Oct. 30, 2014.

4 Woodcock J. Testimony before a House of Representatives subcommittee. April 1, 2014. Accessed Oct. 30, 2014.

5 U.S. General Accountability Office. Drug Shortages: FDA’s Ability to Respond Should Be Strengthened. Dec. 15, 2011. Accessed Oct. 30, 2014.

6 U.S. General Accountability Office. Drug Pricing: Research on Savings From Generic Drug Use. Published Jan. 31, 2012; publicly released Mar. 1, 2012. Accessed Oct. 30, 2014.

7 U.S. General Accountability Office. Drug Shortages: Public Health Threat Continues, Despite Efforts to Help Ensure Product Availability. Feb. 10, 2014. Accessed Oct. 30, 2014.

8 Downing NS et al. Arch Intern Med. 2012;172(9):724-730.

9 FDA Center for Drug Evaluation and Research. Summary Review for Regulatory Action: NDA 203510 (phenylephrine). Accessed Oct. 30, 2014.

10 FDA approval letter: NDA 203510 (phenylephrine). Accessed Oct. 30, 2014.

Meet the Experts

MARCIA CROSSE, PHD Director in the health care group of the U.S. Government Accountability Office. Financial interests: None.

RICHARD H. LEE, MD Comprehensive ophthalmologist at East Bay Eye Specialists and medical director of the EyeMD Laser and Surgery Center, in Oakland, Calif.Financial interests: None.

RALPH G. NEAS President and CEO, Generic Pharmaceutical Association, in Washington, D.C. Financial interests: None.

MARVIN SHEPHERD, PHD Director of the Center for Pharmacoeconomic Studies in the College of Pharmacy, at the University of Texas at Austin; president of Partnership for Safe Medicine. Financial interests: None.

LINDA TSAI, MD Associate professor of ophthalmology at Washington University, in St. Louis, Mo. Financial interests: None.

PETER T. ZACHARIA, MD Glaucoma, cataract, and anterior segment ophthalmologist at Worcester Eye Consultants, in Worcester, Mass. Financial interests: None.

|