Download PDF

In this era of anti-VEGF drugs, ophthalmologists must perform a tricky balancing act, managing financial realities even as they strive to provide optimal patient care.

Once upon a time, financial and administrative tasks were a bit of a headache for ophthalmologists. Now, they’ve become a full-blown migraine.

It is no exaggeration to say the economic realities of running a practice in 2017 require a unique set of business skills. Ophthalmologists now need MBA-level proficiencies to keep their practices financially viable as they navigate the challenges posed by the astronomical prices of vision-saving medications, particularly anti–vascular endothelial growth factor (VEGF) drugs.

The Anti-VEGF Landscape

Clinicians currently have the following choices with regard to anti-VEGF drugs:

Approved and costly. For treating wet age-related macular degeneration (AMD), diabetic macular edema (DME), and other vision-threatening retinal diseases, the U.S. Food and Drug Administration has approved ranibizumab (Lucentis) and aflibercept (Eylea).

Both are expensive: Aflibercept is approximately $1,850 per intravitreal dose, while ranibizumab 0.5 mg—used to treat wet AMD and retinal vein occlusion—has a price tag of $1,950-$2,023 per dose. (Ranibizumab 0.3 mg, used to treat DME, is $1,170 per dose.)

“The financial impact on practices of using these expensive drugs cannot be overstated,” said Michael X. Repka, MD, MBA, at the Wilmer Eye Institute in Baltimore. “Ophthalmologists pay for these drugs up front, serving as the middleman between the payer and the drug supplier.”

To ensure their practices don’t lose money, ophthalmologists “must create extensive administrative systems to track inventory and pursue reimbursement,” said Dr. Repka, who also is the Academy’s Medical Director for Governmental Affairs. “The very small margins they are paid can be wiped out if they aren’t careful.”

Off label and cheap. The less expensive alternative is bevacizumab (Avastin), which received FDA approval in February 2004 to treat colon cancer and is used off label to treat wet AMD, DME, and neovascular glaucoma. Intravitreal Avastin, which must be prepared by compounding pharmacies, costs an average of $50-$60 per dose.

The juggling act. “Retina specialists have had to figure out a way to prescribe the most appropriate vision-saving drugs within the existing payment structure,” Dr. Repka said. “While this structure has existed for expensive oncologic drugs for a long time, it is relatively new to our field and poses a variety of challenges.”

He added that ophthalmologists “must focus not only on providing the best care for their patients but also on protecting their practices from financial loss, which is a real possibility with these expensive drugs.”

|

|

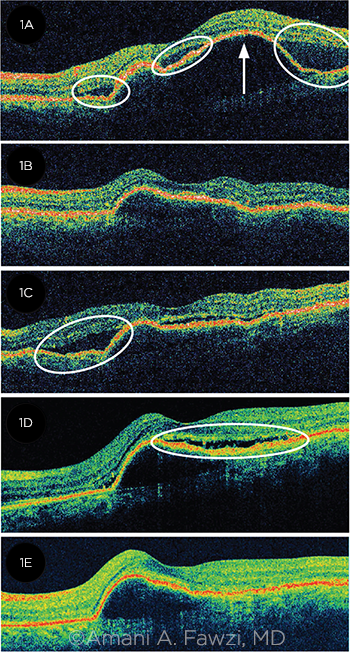

SWITCHING TX. Nuances of patient response can dictate the need to switch between anti-VEGF drugs. A patient with wet AMD (1A) presented with subretinal fluid (SRF, circled), and a serous pigment epithelial detachment (PED, arrow). After 3 injections of ranibizumab, the SRF resolved, and the PED decreased in size (1B). However, the SRF recurred (1C). Despite 6 more injections of ranibizumab, the SRF and PED persisted (1D). The patient was switched to bevacizumab; after 6 injections, the SRF resolved, but the PED remained (1E).

|

Miracle Drugs, Fiscal Nightmares

Alan J. Ruby, MD, who practices in Royal Oak, Michigan, recalls the frustration of treating wet AMD in the 1990s. The treatments available lessened or slowed the severity of vision loss in the long term, but most patients did not enjoy improved visual outcomes.

“The anti-VEGF trials in the early 2000s, culminating in the 2006 approval of Lucentis for wet AMD, completely changed the treatment paradigm,” Dr. Ruby said. “We went from treatment alternatives where no one improved to suddenly being able to treat—and stabilize or improve the vision in—80% to 90% of our wet AMD patients.”

Economic aftermath. Initially, retina surgeons were caught unaware by the financial repercussions of these sight-saving drugs.

David M. Brown, MD, who practices in Houston, was the first author on several papers studying ranibizumab. He witnessed how these drugs were game-changers for patients with wet AMD. “What we didn’t realize at the time was that Lucentis would eventually cost $1,950 per injection, nor could we foresee that anti-VEGF medicines would become a billion-dollar industry.”

Gregg T. Kokame, MD, MMM, who practices in Honolulu, also worked with ranibizumab years before FDA approval. (His practice site served as a study center for the drug.) “We went through the entire process with the drug company and saw very positive results. In some wet AMD patients, we were saving the sight in their only eye, and they still have vision today.”

Negative cash flow. Yet after ranibizumab was approved, cost issues became glaringly apparent. Because the physicians were responsible for purchasing the drug from the pharmaceutical company, “cash flow became a massive liability for the practice,” Dr. Kokame said. “Reimbursement was uncertain, as Medicare and private insurance companies were slow to accept the drug.”

Dr. Kokame added that the economic situation was exacerbated in those early years by the patient load: When anti-VEGF drugs were first available, retina specialists had a backlog of patients who could benefit from the drugs. “It was then we realized that we might not be paid on every dose,” Dr. Kokame said. “We had significant negative cash flow in those days.”

No reimbursement guarantee. Dr. Ruby added that the ophthalmologists were “on the hook” to pay for these medications with no guarantee of being reimbursed, which put ophthalmology practices at risk. Ophthalmologists found themselves in the defensive position of creating strict inventory controls and hiring more staff to deal with reimbursement issues.

Follow the Money

“The cost of doing business is so high,” Dr. Ruby said. “Monitoring of inventory plus billing and reimbursement issues all require huge investments in personnel. We have 2 or 3 people in our practice dedicated solely to monitoring usage of the anti-VEGF drugs. There is so much that can go wrong with the process.”

Fundamental risks. Ophthalmologists who use expensive anti-VEGF drugs are faced with 2 primary financial hurdles:

Initial monetary outlay. The ophthalmologist is responsible for purchasing anti-VEGF drugs from the pharmaceutical companies and is 100% at risk for being reimbursed. “Once the drug is sold to the provider, the pharmaceutical company has zero risk. It’s all on the provider to be reimbursed for the initial outlay of the money,” Dr. Ruby said.

Insurance issues. Reimbursement varies according to whether the patient is covered by Medicare or private insurance. Medicare Part B payment to ophthalmologists when they inject these drugs is set at a 6% markup over the drug’s Average Sales Price (ASP). “However,” said George A. Williams, MD, at Oakland University in Rochester, Michigan, “it gets complicated due to sequestration,” a law first established by the Balanced Budget and Emergency Deficit Control Act of 1985. Sequestration reductions take away 2% of all Centers for Medicare & Medicaid Services (CMS) reimbursements.

Dr. Williams explained that the law does not take away the 2% from the 6% payment. Rather, as a rough example, it takes the 2% from the $106 payment on a $100 drug, leaving the reimbursement at $104.3, or 4.3%.“But it gets more complex in that Medicare only pays 80% of that $104.3, and the remainder is the patient’s responsibility or [is paid for by] secondary insurance,” said Dr. Williams, who is also the Academy’s Secretary for Federal Affairs. “While 4.3% is a relatively strong margin on these drugs, in reality the best-case scenario—after factoring in administrative time and copay plans for reimbursement—is a return of 1%. With a $2,000 drug, that is $20. Now, if a dose is misplaced or not reimbursed at all, it takes 100 injections to make up for that loss.”

With regard to private insurance, nearly all private, non-Medicare insurance plans require prior authorization, said Joanne Mansour, with the Virginia Retina Center in Haymarket, Virginia. This translates into spending many hours on the phone with insurance companies. “You have to know all the rules and requirements, otherwise even 2 mistakes will cost the practice $4,000,” she said (see “Tips for Minimizing Financial Risk”).

|

|

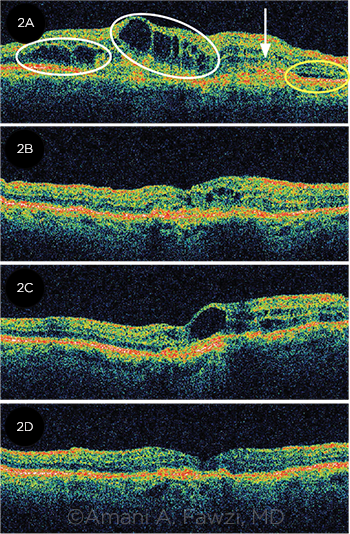

TACHYPHYLAXIS. In another example of the need to switch patients between anti-VEGF drugs, this 85-year-old patient with wet AMD (2A) presented with cystic retinal edema (circled in white), SRF (circled in yellow), and a fibrovascular PED (arrow). After 2 intravitreal injections of bevacizumab, the edema improved and the SRF resolved (2B). However, despite 3 more injections of bevacizumab, the edema worsened (2C). The patient was switched to ranibizumab, and the edema resolved after 3 injections (2D).

|

Does Cost Affect Choice?

In terms of efficacy, the CATT (Comparison of AMD Treatment Trials) Research Group found the monthly use of either bevacizumab or ranibizumab resulted in the same visual acuity (VA) outcomes for patients with wet AMD.1 In addition, compared with bevacizumab or ranibizumab, aflibercept has demonstrated equal efficacy and safety.2

The obvious question is, if the less expensive anti-VEGF medication is as effective as the more expensive drugs for treating wet AMD, why not simply choose bevacizumab?

The answer: It’s not that simple. For instance, “The less expensive drug may work well, but it is not effective for every patient,” Dr. Williams said. Dr. Repka added, “The drugs don’t always work equivalently, and their effectiveness is not equal. Consequently, you can’t know for certain up front which drug will be more effective.”

Nuances in response. That’s particularly true as researchers continue to uncover nuances with regard to treatment. For instance, a report from the Diabetic Retinopathy Clinical Research Network (DRCR.net) compared aflibercept, bevacizumab, and ranibizumab for the treatment of center-involved DME. At the 2-year mark, visual acuity (VA) outcomes of the 3 drugs were similar for eyes with better baseline VA—but aflibercept proved superior for those eyes with worse VA at baseline.3 (See also “DME, Efficacy, and Cost-Effectiveness.”)

And, as many clinicians have found, some patients may need to be moved from one anti-VEGF drug to another based on response.

Overall, Dr. Brown noted, “Avastin is not a bad drug, and it works very well for some patients. But it doesn’t block as much VEGF and isn’t as strong as the other 2 drugs. Consequently, some patients using Avastin require more injections—especially during the initial treatment period when we are trying to calm down the disease.”

Shifts in utilization. Despite the economic and administrative challenges of using the more expensive drugs, data from the Academy’s IRIS Registry indicate that the use of the lower-cost bevacizumab is decreasing. Currently, it is being used 41% of the time, down from 60% earlier, Dr. Williams noted.

“We can’t say why there is decreased utilization” of bevacizumab, said Dr. Williams. It may be due to the difficulties of obtaining it from compounding pharmacies or other aspects of access. In any event, Dr. Williams said, “The Academy’s position is that patients and physicians should have access to all available treatments. If you come to my office with a blinding condition, we should be able to choose which drug is the most appropriate.” (For more on compounded drugs, see “Compounding Pharmacies Face Constraints; Physicians, Patients Feel the Effects” from the May issue of EyeNet.)

|

|

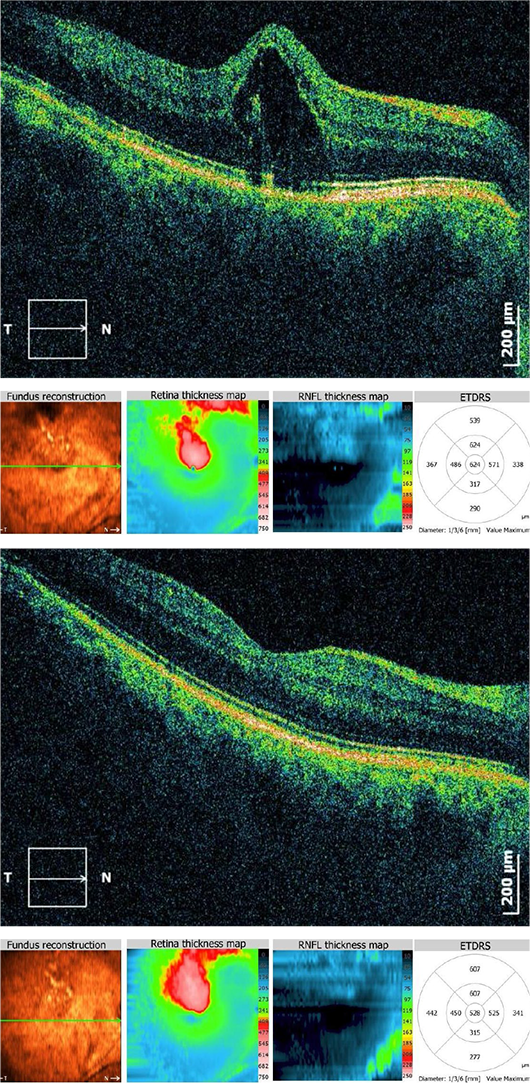

BEFORE AND AFTER. Acceptance of anti-VEGF drugs was fueled by results like these observed with this 61-year-old patient. His cystoid macular edema, secondary to his branch RVO, resolved following treatment. The top image was originally published in the ASRS Retina Image Bank. Ratimir Lazic, MD, PhD, and Marko Lukic, MD. Cystoid Macular Edema Due to Branch Retinal Vein Occlusion. Retina Image Bank. 2012; Image Number 673. © The American Society of Retina Specialists. The bottom image was originally published in the ASRS Retina Image Bank. Ratimir Lazic, MD, PhD, and Marko Lukic, MD. Reduced Cystoid Macular Edema After Anti-VEGF. Treatment. Retina Image Bank. 2012; Image Number 674. © The American Society of Retina Specialists.

|

When Cost Meets Ethics

These financial issues have ethical implications. Hardeep S. Dhindsa, MD, a member of the Academy’s Ethics Committee who is in solo practice in Reno, Nevada, provided a reality check: “In an ideal world, most retina specialists would prefer to give their patients an efficacious, FDA-approved drug on a regular basis.”

Reality check. But in the real world, preauthorization guidelines may require the clinician to use the less expensive option first and switch to the expensive medication only if the first drug isn’t working.

Additionally, private insurance companies track their costs per provider. If, for instance, an individual retina specialist is using more expensive agents than other providers in the same region, the insurance company may favor those clinicians who are using the least expensive options, Dr. Dhindsa said. This has the potential to create an ethical conflict for any physician who wants to remain in favor with the insurance company.

“It gets complicated,” Dr. Dhindsa said. “Our primary responsibility is to the patient, but that now has to be balanced with the physician’s need to control costs. The majority of us will do whatever is right for the patient.” However, he acknowledged, multiple issues involving costs “remain an issue in the back of one’s mind.”

Additional concerns. Other ethical factors to be considered include the following:

FDA approval. As bevacizumab is not approved for treating wet AMD, physicians may, theoretically, be taking on some degree of liability by using it off label.

Volume discounts. Concerns persist regarding the 340B drug pricing program. Under this program, participating hospitals and other covered entities can purchase expensive drugs in bulk or at a discount, yet they are not required to pass this discount along to patients.4 Moreover, some pharmaceutical companies give physicians discounts based on volume for the higher-priced drugs—and these financial incentives to use an agent may not be in the patient’s best interest.

“The professional ethical code of doing what’s in the patient’s best interest has to come first,” Dr. Dhindsa said.

Informed consent. Finally, as Dr. Dhindsa put it, “Do you discuss all the treatment options, or are you just going to start out with Avastin and not tell the patient about his other options? Ethically, patients must be informed of all their options in order to make an educated decision about their own health care.”

A National Debate

The challenges posed by expensive ophthalmic drugs represent a microcosm of the current national debate about drug prices.

The underlying issue is that the United States is the only country in which a governmental payer (Medicare Part B) does not negotiate drug prices with pharmaceutical companies, Dr. Brown said. “The drug companies come up with a price, and there is no negotiation with CMS. In other countries, if the government does not approve of the price of the drugs, they will not pay for it,” he said. “And while the drugs are very beneficial to our patients and have a large impact on the daily lives of surgeons and patients, there should be competitive pricing to make them affordable.”

As Medicare continues to seek ways to reduce spending, Dr. Repka observed, “We need to ensure that ophthalmologists have access to all 3 agents [and future drugs] without worrying about financial loss. It’s an ongoing concern that we will continue to fight.”

___________________________

1 Martin DF et al. N Engl J Med. 2011;364(20):1897-1908.

2 Thomas M et al. Clin Ophthalmol. 2013;7:495-501. doi:10.2147/OPTH.S29974.

3 Wells JA et al. Ophthalmology. 2016;123(6):1351-1359.

4 Traynor K. Am J Health Syst Pharm. 2016;73(1):e3-e4. doi:10.2146/news160003.

DME, Efficacy, and Cost-Effectiveness

A study that looked at aflibercept, bevacizumab, and ranibizumab for the treatment of DME highlights the challenges for the doctor-patient relationship when efficacy results are at odds with cost-effectiveness results1 (often defined in the United States as an incremental cost-effectiveness ratio no greater than $100,000 per quality adjusted life year, or QALY).

Study coauthor Neil M. Bressler, MD, at Wilmer Eye Institute in Baltimore, noted 2 key findings of the study:

- On average, all 3 agents were effective in treating DME. However, for eyes with baseline VA of 20/50 or worse, aflibercept was superior on average to both bevacizumab and ranibizumab

- From a cost-effectiveness perspective, the incremental cost-effectiveness ratio of aflibercept compared with bevacizumab was far greater than $100,000 per QALY at 1 year after initiating therapy or over a 10-year horizon, unless the price of aflibercept were to decrease substantially.

“These results—aflibercept superiority for efficacy but not being cost-effective—highlight the challenges for the doctor-patient relationship,” Dr. Bressler said. Even so, he added, the study’s findings give him the information he needs to help patients make an informed decision about their treatment options.

“I first speak to my DME patients about the safety and efficacy results of the 3 agents, and then I review the cost-effectiveness results,” Dr. Bressler said. “Patients almost always choose to go with the greater chance of efficacy if they have the financial means.” If a patient does not have the money, Dr. Bressler said, he explores other options with a financial counselor.

Dr. Bressler also reminds patients who are financially pressed that “the outcomes at 2 years [not over 2 years] with aflibercept and bevacizumab seem quite similar from the perspective of clinically relevant outcomes [gaining ≥10 or 15 letters from baseline], so that I remain comfortable proceeding with bevacizumab.”

Dr. Bressler observed that ophthalmologists should consider drug costs when prescribing DME treatment—and that when physicians share efficacy, safety, and cost-effectiveness information with their patients, “typically a doctor and patient can come to an agreement on which agent to use when there is a choice of more than 1 treatment.”

___________________________

1 Ross EL et al. JAMA Ophthalmol. 2016;134(8):888-896.

|

Tips for Minimizing Financial Risk

Navigating the world of anti-VEGF drug reimbursement, in which a single slipup can cost literally thousands of dollars, is not for the faint of heart. It’s a minefield out there.

The SNF conundrum. Typically, anti-VEGF drugs are reimbursed under Medicare Part B. However, if patients are being cared for at a Skilled Nursing Facility (SNF), they are only covered by Medicare Part A, which does not reimburse the expensive drugs. “If a patient who is staying at a SNF travels to our office for an injection, and we don’t know the patient is in an SNF and we go ahead with treatment, we won’t be reimbursed for the drug. We lose that $2,000,” said Dr. Brown.

The ACA challenge. If patients do not pay the premium for their policies under the Affordable Care Act (ACA), they may be given a grace period. However, if the insurance is canceled between a Tuesday and Friday, and the injection is given on a Wednesday, “we go to submit the claim, and we cannot retroactively receive the payment,” Dr. Ruby said. “So insurance must be checked every single time.”

In addition, the high deductibles of the ACA plans (and of most private insurers) shift the risk for collecting the money to the physician.

Practice management protocols. To help better navigate these challenges, here are some tips from 2 experienced practice managers—Ricky Bass, MBA, MHA, in North Carolina, and Ms. Mansour, in Virginia:

Fully understand drug assistance programs. For example, the Genentech Access to Care Foundation helps patients who lack insurance coverage. Similarly, the Lucentis Copay Card Program provides copay/coinsurance assistance for patients’ out-of-pocket costs. Federal assistance is available as well. “Practices would benefit from hiring a financial counselor who is 100% dedicated to helping patients gain access to these expensive drugs,” Mr. Bass said. “And drug company representatives can educate physicians and financial staff on their programs.”

Seek inventory efficiencies. Create a detailed and accurate accounting of current supply and a purchasing plan that allows quick shipment.

Track patient visits closely. Monitor appointments scheduled for return treatments and prepare inventory to include these patients. Concurrently, create a certain number of slots for new treatments to prevent shortages and/or oversupplies.

Explore delayed invoice billing with the drug company. This gives the practice time to collect the payment from the patient/insurer without going into debt.

Monitor shelf life and storage. Backup systems are essential to ensure stable temperature for storage. Practices that are vulnerable to power outages must maintain a backup power supply.

In terms of accounting (financial statements), factor out the drugs. It may appear that a physician has been paid $2 million for anti-VEGF medications, but between reimbursement challenges and slim margins, factoring in the drugs skews the profit and loss statement. “It doesn’t reflect what is truly going on financially in the practice,” Ms. Mansour said. “Quite frankly, there truly is no money to be made in these drugs.”

Invest in administrative support. The size of a practice doesn’t matter: All practices must have proper inventory and billing systems, checks and balances in place, and personnel to help patients obtain financial assistance. “If a small practice takes the leap to injecting expensive drugs and then gets behind on reimbursements, even for just a handful of patients, it can be devastating,” Ms. Mansour said.

Take advantage of AAOE’s listservs. “E-talk and E-retina are unmoderated email discussion groups that help us stay on top of trends that directly impact the financial health of the practice. It’s a great forum to exchange ideas,” said Ms. Mansour.

For more advice on managing expensive drugs, see this month’s Savvy Coder, “How to Manage Expensive Drugs.”

|

Meet the Experts

Ricky Bass, MBA, MHA Executive consultant with the American Academy of Ophthalmic Executives and former associate chair for administration at the University of North Carolina’s Department of Ophthalmology, in Chapel Hill, N.C. Relevant financial disclosures: None.

Neil M. Bressler, MD James P. Gills Professor of Ophthalmology and chief of the Retina Division at the Wilmer Eye Institute in Baltimore; editor-in-chief of JAMA Ophthalmology. Relevant financial disclosures: Grant funding was made to his institution, the Johns Hopkins University School of Medicine, for research sponsored by Bayer, Genentech/Roche, Novartis, and Samsung.

David M. Brown, MD In private practice with Retina Consultants of Houston, director of the Greater Houston Retina Research Center, and clinical professor of ophthalmology at Baylor College of Medicine, in Houston. Relevant financial disclosures: Acucela: S; Adverum: C; Alcon: S; Allegro: S; Allergan: C,S; Apellis: S; Bayer: C; Boehringer: C,S; Clearside Biomedical: C,S; Genentech/Roche: C,S; Heidelberg: C; National Eye Institute: S; Novartis: C,S; Ohr: C,S; Ophthotech: S; Optos: C; Optovue: C; Regeneron: C,S; Regenxbio: C,S; Santen: S; Stealth Biotherapeutics: C; ThromboGenics: C; Tyrogenex: S; Xoma: S; Zeiss: C.

Hardeep S. Dhindsa, MD In private practice at the HDRetina Eye Center in Reno, Nev. Relevant financial disclosures: None.

Gregg T. Kokame, MD, MMM Managing partner of Retina Consultants of Hawaii and clinical professor of ophthalmology at the University of Hawaii, in Honolulu. Relevant financial disclosures: Bayer: L; Genentech: S; Novartis: L; Regeneron: S.

Joanne Mansour Practice manager of The Virginia Retina Center in Haymarket, Va. Relevant financial disclosures: None.

Michael X. Repka, MD, MBA David L. Guyton, MD, and Feduniak Family Professor of Ophthalmology at the Wilmer Eye Institute in Baltimore, and the Academy’s Medical Director for Governmental Affairs. Relevant financial disclosures: AAO: S.

Alan J. Ruby, MD In private practice with Associated Retinal Consultants in Royal Oak, Mich., and professor of ophthalmology at Oakland University William Beaumont School of Medicine in Rochester, Mich. Relevant financial disclosures: Allergan: L; Covalent Medical: O; Regeneron: C.

George A. Williams, MD Chair of ophthalmology at Oakland University William Beaumont School of Medicine in Rochester, Mich., and the Academy’s Secretary for Federal Affairs. Relevant financial disclosures: Alcon: C; Allergan: C,S; Covalent Medical: O; ForSight: C,O; Johnson & Johnson: C; Ophthalmic Mutual Insurance Company: E; RetroSense Therapeutics: C,O; ThromboGenics: O; Vitamin Health: C.

For full disclosures and the disclosure key, see below.

|