By Sue Vicchrilli, COT, OCS, OCSR, Academy Director of Coding and Reimbursement

Download PDF

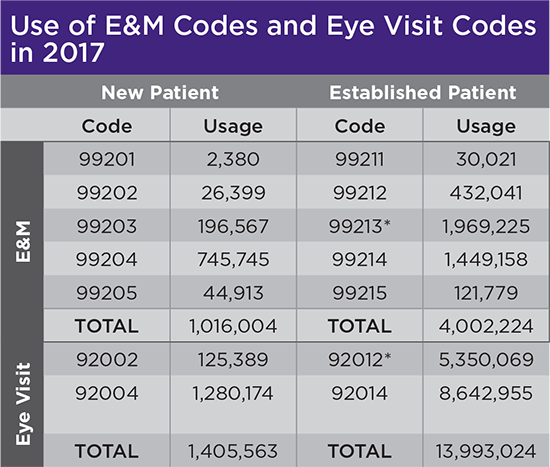

When reporting an office visit, should you submit an E&M code (99XXX) or an Eye visit code (92XXX)? Medicare data show that ophthalmologists tend to report more Eye visit codes, but there are some circumstances in which you should report the E&M code instead.

1. Use an E&M code when the ICD-10 code(s) is not a covered diagnosis for Eye visit codes. Lupus, rheumatoid arthritis, and multiple sclerosis diagnoses are all covered with E&M codes, but not always with Eye visit codes.

2. Use an E&M code when place of service (POS) is not the office. For example, don’t submit an Eye visit code if you are also submitting POS 21 (initial and subsequent hospital care), POS 23 (emergency department services), or POS 32 (initial and subsequent nursing facility).

3. Use an E&M code when a commercial plan caps your use of Eye visit codes. Some commercial plans use what are known as frequency edits to cap use of Eye visit codes for individual patients. For example, some commercial plans limit use of a comprehensive exam Eye visit code (92004 and 92014) to once a year per patient (not per physician), or even once every other year. In such cases you could use an Eye visit code for the first comprehensive exam, but you would use E&M codes for subsequent comprehensive exams that take place during that time period. Note: Medicare does not have frequency edits on Eye visit codes

4. Use an E&M code when a commercial payer requires E&M codes for medical diagnoses. Such a payer would only permit use of Eye visit codes for “routine exams or vision plans.”

5. Use an E&M code when the commercial plan considers that the diagnosis does not warrant a comprehensive exam. For example, one commercial plan has been automatically downcoding a lot of claims from 92014 (comprehensive exam of an established patient) to 92012 (intermediate exam of an established patient). The plan informed practices that this was based on the ICD-10 codes that were used, such as subconjunctival hemorrhage, blepharitis, and primary open-angle glaucoma at quarterly glaucoma evaluation. Note: Commercial plans typically don’t downcode E&M codes based on the diagnosis, but they sometimes downcode Eye visit codes.

6. Use an E&M code if a commercial plan still recognizes consultation codes. Some commercial payers still recognize the 99241-99245 family of E&M codes. Before using these, make sure you aren’t including Medicare as the secondary payer—if you are, you’ll have to write off the 20% balance because Medicare stopped recognizing those codes in 2010.

7. Use an E&M code if it boosts reimbursement. In some cases, the documentation supports a level of exam where an E&M code has the higher Relative Value Units (RVUs) for the individual payer.

8. Use an E&M code when you are performing telemedicine visits. E&M codes identified by an asterisk (*) can be used to report telemedicine visits. Read the Academy’s telemedicine fact sheet at aao.org/practice-management/coding/updates-resources.

9. Use an E&M code when reporting prolonged services codes: 99354-99357. Prolonged services codes can’t be used with Eye visit codes.

|

|

Note: These data represent usage of E&M codes and Eye visit codes by ophthalmologists in Medicare in 2017, but this chart doesn’t include data from Medicare Advantage or commercial plans. (2018 data was not available at time of press.)

* 92012 and 99213 are the first “equivalent exams” between the two families of codes, meaning that CMS considers them to represent a similar level of service. In 2017, ophthalmologists used the Eye visit code 5.35 million times and the E&M code 1.97 million times.

|

What About MIPS?

The cost performance category of the Merit-Based Incentive Payment System (MIPS) includes 12 measures, but only two of them are ever likely to apply to ophthalmologists. One of those two—the Total Per Capita Cost measure—attributes a patient’s Medicare Part A and Part B costs to the clinician who provides the patient with the most primary care services. CMS will attempt to attribute those costs to a primary care clinician, but it is possible that the costs might be attributed to an ophthalmologist.

Significantly, E&M codes—but not Eye visit codes—are counted as primary care services. You would only be scored on the Total Per Capita Cost measure if at least 20 patients are attributed to you during 2019.

Going to AAO 2019? Attend a MIPS event and visit the Academy Resource Center (West, Booth 7337) for help with reporting MIPS via the IRIS Registry.